UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)No.___)

|

| | |

| Filed by the Registrant | [X] | |

| Filed by a Party other than the Registrant | [ ] | |

Check the appropriate box:

|

| |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant tounder §240.14a-12 |

Daktronics, Inc.

(Name of Registrant as Specified in its Charter)

____________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

| [X] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11. |

| | | 1 | | Title of each class of securities to which transaction applies: |

| | | 2 | | Aggregate number of securities to which transaction applies: |

| | | 3 | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | 4 | | Proposed maximum aggregate value of transaction: |

| | | 5 | | Total fee paid: |

| [ ] | | Fee paid previously with preliminary materials. |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | 1 | | Amount previously paid: |

| | | 2 | | Form, Schedule or Registration Statement No.: |

| | | 3 | | Filing Party: |

| | | 4 | | Date Filed: |

DAKTRONICS, INC.

201 Daktronics Drive

Brookings, South Dakota 57006

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AUGUST 31, 2016SEPTEMBER 5, 2018

|

| | |

| Time | 7:00 p.m. Central Daylight Time on Wednesday, August 31, 2016September 5, 2018 |

| | | |

| Place | Daktronics, Inc. |

| | 201 Daktronics Drive |

| | Brookings, South Dakota 57006 |

| | | |

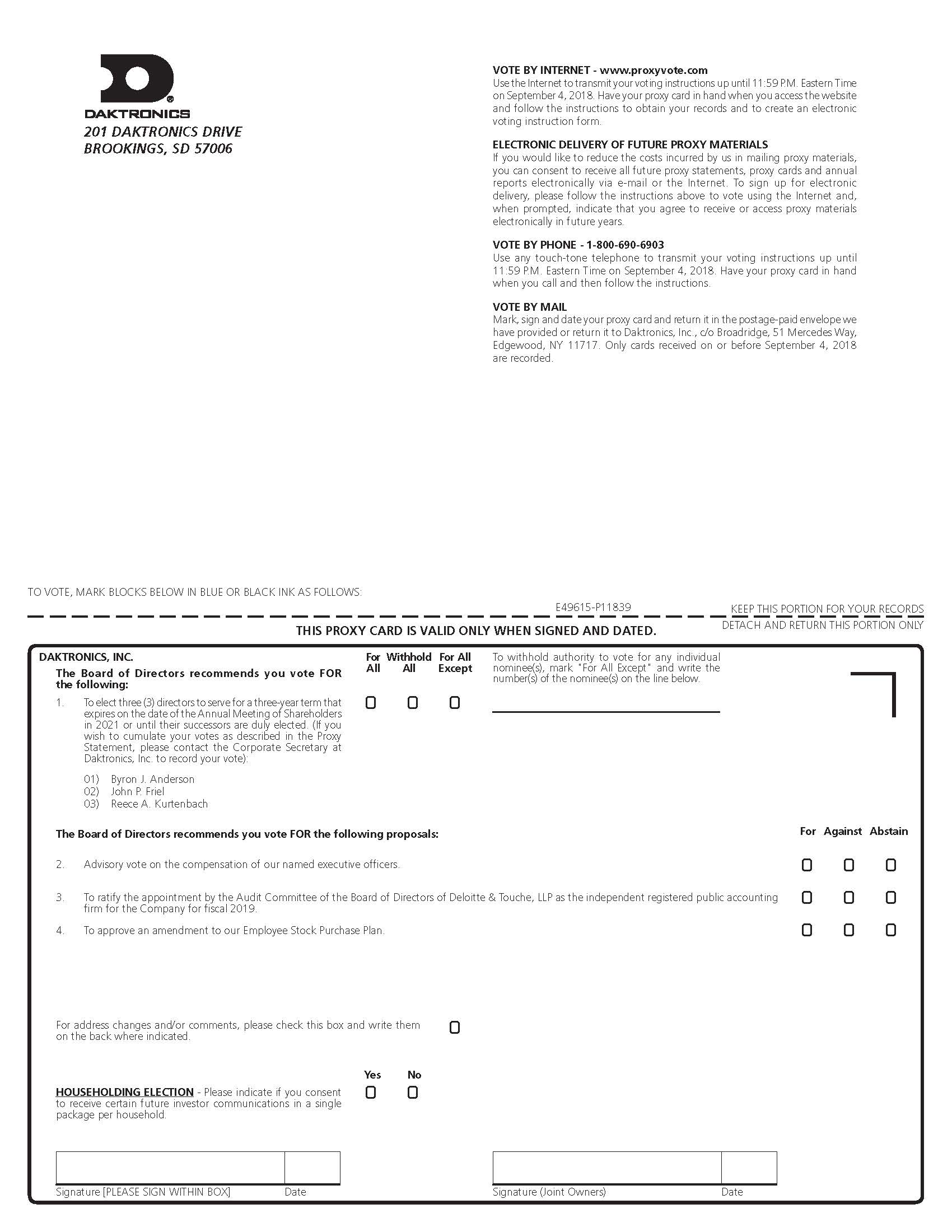

| Items of Business | 1. | To elect three Directors to serve for a three-year term that expires on the date of the Annual Meeting of Shareholders in 20192021 or until their successors are duly elected; |

| | 2. | To conduct an advisory approval of the Company's executive compensation; and |

| | 3. | To ratify the appointment by the Audit Committee of the Board of Directors of ErnstDeloitte & YoungTouche, LLP as our independent registered public accounting firm for the Company for fiscal 2017.2019; and |

| 4. | To approve an amendment to our Employee Stock Purchase Plan. |

| | | |

| Record Date | You are entitled to vote if you were a shareholder of record at the close of business on June 27, 2016.July 2, 2018. |

| | | |

| Annual Meeting | All shareholders are invited to attend the Annual Meeting in person. |

| | | |

| Voting by Proxy | Even if you plan to attend the Annual Meeting, please submit a proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Shareholders may vote their shares: |

| | 1. | over the Internet; |

| | 2. | by telephone; or |

| | 3. | by mail. |

| | | |

| | For specific instructions, refer to the procedural matters section of the proxy statementProxy Statement or to the voting instructions on the proxy card, both of which accompany this notice. |

THIS PROXY STATEMENT AND PROXY CARD ARE BEING DISTRIBUTED ON OR ABOUT JULY 12, 2016.17, 2018.

|

| |

| | By Order of the Board of Directors, |

| |

| | |

| | Carla S. Gatzke |

| | Secretary |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE DAKTRONICS, INC. ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 31, 2016SEPTEMBER 5, 2018.

This notice and the accompanying proxy statement,Proxy Statement, proxy card and our Fiscal 20162018 Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the fiscal year ended April 30, 201628, 2018, are available at our website at www.daktronics.com. Additionally, and in accordance with the rules of the Securities and Exchange Commission, shareholders may access these materials at the cookies-free website indicated in the Notice of Internet Availability of Proxy Materials that you receive in connection with this notice and the accompanying proxy statement.Proxy Statement.

Daktronics, Inc.

Table of Contents

DAKTRONICS, INC.

PROXY STATEMENT

FOR 20162018 ANNUAL MEETING OF SHAREHOLDERS

PROCEDURAL MATTERS

General

The enclosed proxy is solicited by and on behalf of the Board of Directors of Daktronics, Inc., a South Dakota corporation, for use at our Annual Meeting of Shareholders to be held on Wednesday, August 31, 2016September 5, 2018 at Daktronics, Inc., 201 Daktronics Drive, Brookings, South Dakota at 7:00 p.m. Central Daylight Time, and at any adjournment or postponement thereof (the “Annual Meeting”"Annual Meeting"), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement and the accompanying form of proxy, together with our fiscal yearFiscal 20162018 Annual Report to Shareholders, are being made available to shareholders on the Internet or are being mailed on or about July 12, 201617, 2018 to shareholders entitled to vote at the Annual Meeting.

In this Proxy Statement, “Daktronics”"Daktronics", “Company”"Company", “registrant”"registrant", “we”"we", “us”"us" and “our”"our" refer to Daktronics, Inc.

Shareholders Entitled to Vote; Record Date

Only shareholders of record at the close of business on June 27, 2016July 2, 2018 (the “Record Date”"Record Date") are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 44,093,05444,588,625 shares of our common stock outstanding and entitled to vote held by 1,1331,043 shareholders of record.

Notice of Internet Availability of Proxy Materials

We are making proxy materials for the Annual Meeting available over the Internet. Therefore, we are mailing to the majority of our shareholders a notice about the Internet availability of the proxy materials instead of a paper copy of the proxy materials. The notice is entitled “Notice"Notice of Internet Availability of Proxy Materials.”" All shareholders receiving the notice will have the ability to access the proxy materials over the Internet and to request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found on the notice. Our proxy materials may also be accessed on our website at www.daktronics.com by selecting "About Us""Menu", then “Investor Relations”"Investor" and then “Annual"Annual Reports and Proxies"Proxy" under the heading "Financial Information.”" We are providing some of our shareholders, including shareholders who have previously requested to receive paper copies of the proxy materials, with paper copies of the proxy materials instead of the Notice of Internet Availability of Proxy Materials.

Voting at the Annual Meeting; Vote Requirements

The holders of a majority of the shares of common stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum for the transaction of business. If a quorum is not present, the Annual Meeting may be adjourned from time to time until a quorum is present. Abstentions and broker non-votes will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Each share is entitled to one vote on all matters submitted to a vote. However, with respect to only the election of Directors, every shareholder will have the right to cast a number of votes equal to the number of Directors to be elected at the Annual Meeting multiplied by the number of shares the shareholder is entitled to vote. Shareholders may cast all votes for one nominee or divide the votes as they choose among two or more nominees. Shares abstaining will be treated as not voted.

A plurality of the votes cast is required for the election of Directors. This means that the Director nominee with the most votes for a particular slot is elected for that slot. Only votes “for”"for" or “withheld”"withheld" affect the outcome. Abstentions are not counted for purposes of the election of Directors. The affirmative vote of a majority of the shares of common stock represented at the Annual Meeting, either in person or by proxy, assuming a quorum is present, is required to approve any of the other proposals. If an executed proxy is returned and the shareholder has abstained from voting on any matter, the shares represented by such proxy will be considered present at the Annual Meeting for purposes of determining a quorum and for purposes of calculating the vote, but they will not be considered to have been voted in favor of such matter. If a signed proxy is returned by a broker holding shares in “street"street name,”" and it indicates that the broker does not have discretionary authority to vote certain shares on one or more matters, such shares will be considered present at the Annual Meeting for purposes of determining a quorum but will not be considered to be represented at the Annual Meeting for purposes of calculating the vote with respect to such matter.

Counting Votes

The inspector of election appointed for the Annual Meeting will count the votes cast by proxy or in person at the Annual Meeting.

Brokers who hold shares in street name for customers will not be able to vote the shares without instructions from their customers with respect to any of the proposals, other than the proposal to ratify the selection of our auditors (Proposal Three of this Proxy Statement).

Shares for which brokers have not received instructions, and which therefore are not voted, with respect to a particular proposal are

referred to as “broker non-votes”"broker non-votes" with respect to that proposal. Abstentions from voting on a proposal described in this proxy statementProxy Statement and broker non-votes will not affect the outcome of the vote on that proposal.

How Votes are Submitted

If the shares of our common stock are held directly in the name of the shareholder, he or she can vote on matters to come before the Annual Meeting:

by completing, dating and signing the proxy card and returning it to us in the postage-paid envelope provided for that purpose, if the shareholder has received a paper copy of a proxy card;

by written ballot at the Annual Meeting;

by telephone, by calling 1-800-690-6903; or

by Internet, at www.proxyvote.com.

Shareholders whose shares of our common stock are held in “street name”"street name" must either direct the record holder of their shares as to how to vote their shares of common stock or obtain a proxy from the record holder to vote at the Annual Meeting. “Street name”"Street name" shareholders should check the voting instruction cards used by their brokers or nominees for specific instructions on methods of voting, including by telephone or using the Internet.

Participants in the Daktronics, Inc. 401(k) Plan (the “401(k) Plan”"401(k) Plan") who hold our common stock in the 401(k) Plan are entitled to instruct the trustee of the 401(k) Plan as to how to vote their shares. Each participant will receive a Notice of Internet Availability of Proxy Materials, similar to the notice received by the registered holders described above. Each participant will have the ability to access the proxy materials over the Internet and to request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found on the notice as described above. The participants can vote on matters as described above. The votes will then be tabulated and submitted for vote by the trustee for the 401(k) Plan. If a participant does not timely vote, the trustee will vote the shares allocated to that participant in the same proportion as the shares that are voted by all other participants under the 401(k) Plan.

Proxies

All shares entitled to vote and represented by properly submitted proxies received before the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies if they are not revoked before the vote as described below. If no instructions are indicated on a properly submitted proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the Annual Meeting, the proxy holders will have discretion to vote on those matters in accordance with their best judgment.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. A proxy may be revoked by:

delivering a written notice of revocation to the Secretary of the Company;

submitting another proxy bearing a later date;

voting by telephone or via the Internet after a prior telephone or Internet vote; or

attending the Annual Meeting and voting in person (although attendance at the Annual Meeting alone will not itself revoke a proxy).

Expenses of Solicitation

All expenses of this solicitation, including the cost of preparing and mailing this Proxy Statement, will be borne by us. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our Directors, officers and employees may also solicit proxies in person or by telephone, email, letter or facsimile. Such Directors, officers and employees will not be additionally compensated, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation.

Procedure for Submitting Shareholder Proposals

Shareholders may present proper proposals for inclusion in our proxy materials for consideration at the next annual meeting of our shareholders by submitting their proposals to us in a timely manner. In order to be included in our proxy materials for the next annual meeting, shareholder proposals must be received by us no later than March 14, 201719, 2019 and must otherwise comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934. If a shareholder wants to nominate a Director or bring other business before the shareholders at the next annual meeting of our shareholders without including the proposal in our proxy statement,Proxy Statement, we must receive notice of the proposal on or before May 28, 2017,June 2, 2019, and the shareholder must otherwise comply with Rule 14a-4(c) under the Securities

Exchange Act of 1934. Notices of intention to present proposals at the 20172019 annual meeting of shareholders should be addressed to Corporate Secretary, Daktronics, Inc., 201 Daktronics Drive, Brookings, South Dakota 57006.

At the date of this Proxy Statement, management knows of no other business that may properly come before the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the individuals named in enclosed form of the proxy will vote the proxies received in response to this solicitation in accordance with their best judgment on such matters.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of common stock as of June 27, 2016July 2, 2018, the Record Date, by each of our Directors, by each executive officer named in the Summary Compensation Table, by all Directors and executive officers as a group, and by each shareholder who is known by us to own beneficially more than five percent of our outstanding common stock.

| | | Name and Address of Beneficial Owners | | Note | | Amount and Nature of Beneficial Ownership(1) | | Percentage of Outstanding Shares(2) | | Note | | Amount and Nature of Beneficial Ownership(1) | | Percentage of Outstanding Shares(2) |

| 5% Beneficial Owners: | | (15) | | | | | | (15) | | | | |

| BlackRock, Inc. | | (16) | | 3,656,729 |

| | 8.3 | % | | (16) | | 4,815,679 |

| | 10.8 | % |

| 40 East 52nd Street | | | | | |

| New York, NY 10022 | | | | | |

| RidgeWorth Capital Management LLC as Parent Company for Ceredex Value Advisors LLC | | (17) | | 2,002,046 |

| | 4.5 | % | |

| 3333 Piedmont Road NE, Suite 1500 | | | | | |

| Atlanta, GA 30305 | | | | | |

| 55 East 52nd Street | | | | | |

| New York, NY 10055 | | | | | |

| Dimensional Fund Advisors LP | | | (17) | | 2,655,285 |

| | 6.0 | % |

| Building One, 6300 Bee Cave Road | | | | | |

| Austin, TX 78746 | | | | | |

| Dr. Aelred J. Kurtenbach | | (18) | | 2,655,987 |

| | 6.0 | % | | (18) | | 2,436,916 |

| | 5.5 | % |

| Daktronics, Inc. 401(k) Plan | | (19) | | 2,858,014 |

| | 6.5 | % | | (19) | | 2,709,055 |

| | 6.1 | % |

| Named Executive Officers and Directors: | | | | | | | | |

| Reece A. Kurtenbach | | (3) | | 438,558 |

| | 1.0 | % | | (3) | | 485,726 |

| | 1.1 | % |

| James B. Morgan | | (4) | | 1,506,116 |

| | 3.4 | % | | (4) | | 1,404,297 |

| | 3.1 | % |

| Byron J. Anderson | | (5) | | 75,353 |

| | * |

| | (5) | | 87,040 |

| | * |

|

| Robert G. Dutcher | | (6) | | 78,612 |

| | * |

| | (6) | | 95,866 |

| | * |

|

| Nancy D. Frame | | (7) | | 91,693 |

| | * |

| | (7) | | 111,422 |

| | * |

|

| John L. Mulligan | | (8) | | 100,271 |

| | * |

| | (8) | | 64,218 |

| | * |

|

| Kevin P. McDermott | | (9) | | 20,312 |

| | * |

| | (9) | | 39,618 |

| | * |

|

| John P. Friel | | (10) | | 17,716 |

| | * |

| | (10) | | 34,970 |

| | * |

|

| Sheila M. Anderson | | (11) | | 51,614 |

| | * |

| | (11) | | 67,609 |

| | * |

|

| Bradley T. Wiemann | | (12) | | 228,308 |

| | * |

| | (12) | | 170,786 |

| | * |

|

| Matthew J. Kurtenbach | | (13) | | 322,140 |

| | * |

| | (13) | | 326,973 |

| | * |

|

| Carla S. Gatzke | | (14) | | 762,333 |

| | 1.7 | % | | (14) | | 763,354 |

| | 1.7 | % |

| All Directors and executive officers as a group | | | | | | | | | | | | |

| (12 persons, consisting of those named above) | | 3,693,026 |

| | 8.4 | % | | 3,651,879 |

| | 8.2 | % |

* Less than one percent

| |

| (1) | Each person has sole voting and sole dispositive power with respect to all outstanding shares, except as noted. The individuals holding restricted shares have the power to vote but not the power to dispose of such shares. |

| |

| (2) | Applicable percentage ownership is based on 44,093,05444,588,625 shares of common stock outstanding as of June 27, 2016July 2, 2018. In computing the number of shares of common stock beneficially owned by a person or group and the percentage ownership of that person or group, we deemed outstanding shares of common stock subject to options held by that person or group that are currently exercisable, options held by that person or group that are exercisable within 60 days of June 27, 2016,July 2, 2018, and restricted stock units that are scheduled to vest within 60 days of June 27, 2016.July 2, 2018. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. |

| |

| (3) | Includes 90,445108,228 shares subject to options, 28,42330,191 shares held through the 401(k) Plan, 17,400 shares held by his spouse, 44,800 shares held by his children and 3,5325,500 shares of restricted stock with which vest within 60 days from June 27, 2016.July 2, 2018. |

| |

| (4) | Includes 55,36227,928 shares held through the 401(k) Plansubject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (5) | Includes 56,93053,726 shares subject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (6) | Includes 45,42153,726 shares subject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (7) | Includes 38,42146,726 shares subject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (8) | Includes 19,62327,928 shares subject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (9) | Includes 9,19117,496 shares subject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (10) | Includes 9,19117,496 shares subject to exercisable options and 3,5255,815 shares of restricted stock which vest on September 3, 2016.August 31, 2018. |

| |

| (11) | Includes 35,76745,315 shares subject to options, 6,1867,683 shares held through the 401(k) Plan and 2,1502,950 shares of restricted stock which vest within 60 days from June 27, 2016.July 2, 2018. |

| |

| (12) | Includes 70,19571,955 shares subject to options, 38,5591,687 shares held through the 401(k) Plan, 559597 shares held by his spouse and 2,2323,000 shares of restricted stock which vest within 60 days from June 27, 2016.July 2, 2018. |

| |

| (13) | Includes 69,95571,655 shares subject to options, 12,85914,466 shares held through 401(k) Plan, 31,10039,100 shares held by his children and 2,2203,000 shares of restricted stock which vest within 60 days from June 27, 2016.July 2, 2018. |

| |

| (14) | Includes 65,59966,565 shares subject to options, 133,276137,626 shares held through the 401(k) Plan, 90,000 shares held by her spouse, 30,385 shares held by her children and 2,0702,750 shares of restricted stock with which vest within 60 days from June 27, 2016.July 2, 2018. |

| |

| (15) | To the Company's knowledge, except as noted in the table above, no person or entity is the beneficial owner of more than 5%five percent of the outstanding shares of the Company's common stock. |

| |

| (16) | Data based on an Amendment to Schedule 13G13G/A filed by the shareholder with the Securities and Exchange Commission (the "SEC") on February 10, 2016.January 19, 2018. As set forth in the Schedule 13G, Blackrock,13G/A, BlackRock, Inc. has sole voting power as to 3,566,0414,726,924 of these shares and sole dispositive power as to all 3,656,7294,815,679 shares. |

| |

| (17) | Data based on an Amendment to Schedule 13G13G/A filed by the shareholder with the SEC on February 09, 2016.2018. As set forth in the Schedule 13G, RidgeWorth Capital Management LLC, as Parent Company for Ceredex Value13G/A, Dimensional Fund Advisors LLC,LP has sole voting power as to 1,441,7262,504,831 of these shares and sole dispositive power as to all 2,002,0462,655,285 shares. |

| |

| (18) | Includes 1,084,461920,412 shares held by his spouse, Irene Kurtenbach, and 300,000531,675 shares held in Medary Creek LLLP. Medary Creek LLLP is a limited liability limited partnership of which Aelred and Irene Kurtenbach are the general partners. |

| |

| (19) | The common stock held by the 401(k) Plan and allocated to the 401(k) Plan participants are voted by the trustee of the 401(k) Plan according to the instructions of the 401(k) Plan participants. The address of the 401(k) Plan is 201 Daktronics Drive, Brookings, South Dakota 57006. |

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Our Board of Directors consists of eight individuals divided into three classes serving staggered three-year terms of office. There are three Directors (Byron J. Anderson, John P. Friel, and Reece A. Kurtenbach) whose terms will expire at the 2018 Annual Meeting; three Directors (James B. Morgan, John L. Mulligan, and Kevin P. McDermott) whose terms will expire at the 2016 Annual Meeting;in 2019; and two Directors (Robert G. Dutcher and Nancy D. Frame) whose terms expire in 2017; and three Directors (Byron J. Anderson, John P. Friel, and Reece A. Kurtenbach) whose terms will expire in 2018.2020. The Nominating and Corporate Governance Committee has recommended to the Board of Directors that James B. Morgan,Byron J. Anderson, John L. Mulligan,P. Friel, and Kevin P. McDermottReece A. Kurtenbach be nominated for re-election at the 20162018 Annual Meeting, and the Board of Directors has approved that recommendation. All nominees have consented to being named as a nominee in this proxy statementProxy Statement and have indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board, unless a contrary instruction is indicated on the proxy.

Vote Required

See “Procedural"Procedural Matters – Voting at the Annual Meeting: Vote Requirements”Requirements" for a description of the votes required for the election of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR”"FOR" THE ELECTION OF THE NOMINEES FOR DIRECTORS NAMED BELOW.

Directors and Nominees for Director

The following table sets forth the name, age and certain other information about each nominee for Director as of the Record Date:

|

| | | | | | |

| Name | | Age | | Principal Occupation | | Committees Served On |

James B. MorganByron J. Anderson | | 6974 | | Retired | | Compensation Committee; Nominating and Corporate Governance Committee |

John L. MulliganP. Friel | | 7764 | | Investment associate with UBSDirector at Preservation Technologies LLC; Director at Blue Water Growth LLC; and President and CEO and Board Member at Vascor, Inc.

| | Audit Committee; Compensation Committee Chair |

Kevin P. McDermottReece A. Kurtenbach | | 6253 | | Provides litigation support consulting services on a part time basis; a board member of Genesco Inc.President and Chief Executive Officer | | Audit Committee |

James B. Morgan (69) is currently retired. He has been a Director since 1984. He served as the Company's President and Chief Executive Officer from 2001 through his retirement effective on September 1, 2013. Prior to that he served as President and Chief Operating Officer and Vice President for Engineering. He originally joined the Company in 1969 as its first design engineer. He holds a Bachelor of Science degree and a Master of Science degree in electrical engineering from South Dakota State University. Mr. Morgan brings to the Board his experience and knowledge of our business and industry derived from his previous positions as President and Chief Executive Officer and his experience of over 45 years working for the Company.

John L. Mulligan (77) has been a Director and has served as chairperson of the Audit Committee since 1993. Since 1993, he has been employed by a number of financial institutions as a financial advisor and Vice President. He has been employed by UBS since May 2008 and, from 1999 through May 2008, he was with Morgan Stanley. From 1967 to March 1990, he served as President, Chairman, Chief Executive Officer and Director of American Western Corporation, a publicly-held company. Mr. Mulligan also served as a certified public accountant early in his career. Mr. Mulligan brings to the Board a significant amount of financial expertise from his experience in the financial services industry as well as a deep understanding of shareholder issues and concerns based on his more than 20-year career as chief executive officer of a public company.

Kevin P. McDermott (62) has been a Director since June 2015. Mr. McDermott joins the board of directors with 33 years of experience with the accounting firm of KPMG LLP, including audit engagement partner, SEC reviewing partner, professional practice partner, and in the firm’s Office of General Counsel. In addition to fulfilling professional obligations related to audits of financial statements and internal control over financial reporting, he assisted clients with financial and operational issues, acquisition due diligence, personnel performance, and corporate governance. In his capacity as SEC reviewing partner, Mr. McDermott performed concurring partner reviews of audits of financial statements and internal control over financial reporting for publicly-held audit clients. While in the Office of General Counsel, he provided assistance on a privileged basis to the firm and outside counsel in various SEC and Public Company Accounting Oversight Board investigations and third party litigation matters. Although Mr. McDermott retired from KPMG LLP, he provides litigation support consulting services on a part time basis. He is a licensed Certified Public Accountant in Tennessee and New York and holds a Bachelor of Science in economics from South Dakota State University. Mr. McDermott was appointed to the board of directors of Genesco Inc. effective February 1, 2016. Mr. McDermott brings significant expertise in the area of financial and internal control reporting

by publicly traded companies. This expertise aligns with our responsibility and commitment to provide oversight for our shareholders and others relating to the integrity of our financial statements and related filings.

The identity of the remaining Directors and certain information about them as of the Record Date are set forth below:

Robert G. Dutcher (71) is currently retired. He has been a Director of the Company since 2002 and chairperson of the Compensation Committee since 2005. Before his retirement, from April 2009 until March 2011, he served as Strategic Advisor Lead Member of MEDRAD, Inc. From April 2008 through March 2009, he was President and Chief Executive Officer of the Cardiovascular Division of MEDRAD, Inc. From 2001 until April 2008, he was the Chairman, President and Chief Executive Officer of Possis Medical, Inc., a publicly-held medical device company located in Minneapolis, Minnesota, which was acquired by MEDRAD, Inc. in April 2008. From 1993 until April 2008, he served as President and Chief Executive Officer of Possis Medical. Before joining Possis Medical in 1985, he was with Medtronic, Inc. for 12 years, most recently as Director of Research and Development. He previously worked in an engineering capacity for Control Data Corporation and Honeywell, Inc. Mr. Dutcher holds a Bachelor of Science degree in electrical engineering from South Dakota State University and a Master of Science degree in electrical engineering from the University of Minnesota. Mr. Dutcher brings to the Board extensive knowledge in driving profitable growth in technology driven industries from his experience in leading R&D at Medtronic and as Chief Executive Officer of Possis Medical.

Nancy D. Frame (71) is currently retired. She has been a Director of the Company since 1999, chairperson of the Nominating and Corporate Governance Committee since 2004 and Lead Independent Director since 2005. She also serves as a member of the Compensation Committee. Shewas Deputy Director of the U.S. Trade and Development Agency from 1986 to 1999, when she retired. As a senior executive in this federal government agency, she was responsible for managing its day-to-day operations, budget, system of financial controls, and ethics program. From 1980 to 1986, she was Assistant General Counsel at the U.S. Agency for International Development, where she was in charge of all legal matters affecting personnel, labor relations and ethics. Before that she held various legal positions in the areas of international trade and commercial law. She has a law degree from Georgetown University, Washington, D.C. and a Bachelor of Science degree from South Dakota State University. Ms. Frame brings to the Board a legal and managerial background which is particularly pertinent to corporate governance and risk oversight and to understanding the legal issues faced by the Company, especially as they relate to our international development.

Byron J. Anderson (72)(74) is currently retired. He has been a Director of the Company since 2005 and has served on the Compensation Committee and Nominating and Corporate Governance Committee since November 2005 and on the Audit Committee since May 2015.2005. Before his retirement, from 1999 to 2004, he served at Agilent Technologies, Inc. as Senior Vice President serving customers and managing business groups located in the United States, Europe, Japan and Asia, which included worldwide sales and service activities. Before working with Agilent, he held various senior positions with Hewlett-Packard Company, ending his career theremost recently as a Vice President responsible for a business unit serving the worldwide communications industry. He holds ana Master of Business Administration from Harvard University and an electrical engineering degree from South Dakota State University. Mr. Anderson brings to the Board significant experience in high-tech industry with a unique knowledge of supply chains, international development, foreign trade and corporate strategy obtained from his years in management of large multi-national, technology companies.

John P. Friel (64)has been a Director since September 2015 and has served on the Audit Committee since September 2015 and on the Compensation Committee since October 2016. Mr. Friel served for 30 years in various capacities at MEDRAD, Inc., a global company that designs, develops, manufactures, sells, and supports medical devices. MEDRAD is an affiliate of Bayer, AG. He joined MEDRAD in the accounting area and earned a promotion to Treasurer and Vice President of Corporate Planning in 1986 and Vice President of Business Development area in 1987. He then served as Executive Vice President of Sales and Marketing from 1989 to 1995, Senior Vice President and General Manager from 1995 to 1998, and as President and Chief Executive Officer from 1998 to 2010. MEDRAD received the Malcolm Baldrige National Quality Award twice during his tenure, once in 2004 and again in 2010. Mr. Friel is currently the President and CEO of Vascor, Inc. Vascor is a pre-clinical medical device development company. He also is currently the Managing Director at Preservation Technologies L.P. and a Director of the medical device industry segment at Blue Water Growth LLC. Mr. Friel is the Principal and Founder of Five Radicals, which focuses on Baldrige Performance Excellence, strategic planning, general business consulting to entrepreneurial medical device companies, and private equity business development opportunity search efforts. He holds a Master of Arts in Law and Diplomacy from Tufts University and a Bachelor of Arts in Political Science and Bachelor of Science in Accounting from Pennsylvania State University. Mr. Friel brings to the Board extensive global general management knowledge and practice. He has strong experience in building and growing businesses, especially in technical product development and global expansions, which align with many of the Company's initiatives and strategies.

Reece A. Kurtenbach (51)(53) was appointed as President and Chief Executive Officer and a Director effective on September 1, 2013 and has served as Chairman of the Board since September 2014. He served as Executive Vice President from 2012 until September 2013, Vice President for Live Events and International from 2007 to 2012, Vice President for Video Systems from 2004 until 2007, and manager for video products engineering from 1994 until 2004. Mr. Kurtenbach joined the Company in 1991 as an applications engineer focusing on large display projects. Mr. Kurtenbach also worked as a student employee with various responsibilities from 1983 to 1987. Mr. Kurtenbach holds a Bachelor of Science degree from South Dakota State University in electrical engineering, with minors in mathematics and computer science. Mr. Kurtenbach is the son of Dr. Aelred Kurtenbach.Kurtenbach and brother of Matthew J. Kurtenbach and Carla S. Gatzke. The Board believes that Mr. Kurtenbach is an appropriate representative of management on the Board given his position as a senior executive officer and his long tenure with the Company which dates back 29more than 30 years. In addition, Mr. Kurtenbach brings a wealth of industry experience to the Board.

The identity of the remaining Directors and certain information about them as of the Record Date are set forth below:

John P. Friel (62)Robert G. Dutcher (73) is currently retired. He has been a Director of the Company since 2002 and chairperson of the Compensation Committee since 2005. Before his retirement, from April 2009 until March 2011, he served as Strategic Advisor Lead Member of MEDRAD, Inc. From April 2008 through March 2009, he was President and Chief Executive Officer of the Cardiovascular Division of MEDRAD, Inc. From 1993 until April 2008, he was the President and Chief Executive Officer of Possis Medical, Inc., a publicly-held medical device company located in Minneapolis, Minnesota, which was acquired by MEDRAD, Inc. in April 2008. From December 2001 until April 2008, he served as Chairman of the Board of Possis Medical, Inc. Before joining Possis Medical in 1985, he was with Medtronic, Inc. for 12 years, most recently as Director of Research and Development. He previously worked in an engineering capacity for Control Data Corporation and Honeywell, Inc. Mr. Dutcher holds a Bachelor of Science degree in electrical engineering from South Dakota State University and a Master of Science degree in electrical engineering from the University of Minnesota. Mr. Dutcher brings to the Board extensive knowledge in driving profitable growth in technology driven industries from his experience in leading R&D at Medtronic and as Chief Executive Officer of Possis Medical.

Nancy D. Frame (73) is currently retired. She has been a Director of the Company since 1999, chairperson of the Nominating and Corporate Governance Committee since 2004 and Lead Independent Director since 2005. Shewas Deputy Director of the U.S. Trade and Development Agency from 1986 to 1999, when she retired. As a senior executive in this federal government agency, she was responsible for managing its day-to-day operations, budget, system of financial controls, and ethics program. From 1980 to 1986, she was Assistant General Counsel at the U.S. Agency for International Development, where she was in charge of all legal matters affecting personnel, labor relations and ethics. Before that she held various legal positions in the areas of international trade and commercial law. She has a law degree from Georgetown University, Washington, D.C., and a Bachelor of Science degree from South Dakota State University. Ms. Frame brings to the Board a legal and managerial background which is particularly pertinent to corporate governance and risk oversight and to understanding the legal issues faced by the Company, especially as they relate to our international development.

James B. Morgan (71) is currently retired. He has been a Director since 1984 and has served on the Audit Committee and Nominating and Corporate Governance Committee since October 2016. He served as the Company's President and Chief Executive Officer from 2001 through his retirement effective on September 2015. Mr. Friel1, 2013. Prior to that he served for 30 years in various capacities at MEDRAD, Inc., a global company that designs, develops, manufactures, sells,as President and supports medical devices. MEDRAD is an affiliate of Bayer, AG. He joined MEDRAD in the accounting area and earned a promotion to TreasurerChief Operating Officer and Vice President for Engineering. He originally joined the Company in corporate planning1969 as its first design engineer. He holds a Bachelor of Science degree and a Master of Science degree in 1986electrical engineering from South Dakota State University. Mr. Morgan brings to the Board his experience and in theknowledge of our business development area in 1987. He then served as Executive Vice President of Sales and Marketingindustry derived from 1989 to 1995, Senior Vice President and general manager from 1995 to 1998, andhis previous positions as President and Chief Executive Officer from 1998 to 2010. MEDRAD receivedand his experience of over 44 years working for the Malcolm Baldrige National Quality Award twice during his tenure - in 2004 and again in 2010. Mr. FrielCompany.

John L. Mulligan (79) is currently retired. He has been a Director since 1993 and has served on the managing director at Preservation Technologies L.P., the directorAudit Committee as Chairman from 1993 through September 2016 and as a member since October 2016. Since 1993, he has been employed by a number of the medical device industry segment at Blue Water Growth LLC,financial institutions as a financial advisor and Vice President. He was employed by UBS from May 2008 through June 2017 and, from 1999 through May 2008, he was with Morgan Stanley. From 1967 to March 1990, he served as President, Chairman, Chief Executive Officer and Director of American Western Corporation, a business consultant and board member of various companiespublicly-held company. Mr. Mulligan also served as a certified public accountant early in his position at Five Radicals LLC.career. Mr. FrielMulligan brings to the Board a significant amount of financial expertise from his experience in the financial services industry as well as a deep understanding of shareholder issues and concerns based on his more than 20-year career as chief executive officer of a public company.

Kevin P. McDermott (64) has been a Director since June 2015 and has served on the Audit Committee as a member from August 2015 through September 2016 and as Chairman since October 2016. Mr. McDermott retired from international accounting firm KPMG LLP in the fall of 2013 after having been with the firm for 33 years in various capacities, including audit engagement partner, SEC reviewing partner, professional practice partner, and in the firm’s Office of General Counsel. In addition to fulfilling professional obligations related to audits of financial statements and internal control over financial reporting, he assisted clients with financial and operational issues, acquisition due diligence, personnel performance, and corporate governance. In his capacity as SEC reviewing partner, Mr. McDermott performed concurring partner reviews of audits of financial statements and internal control over financial reporting for publicly-held audit clients. While in the Office of General Counsel, he provided assistance on a privileged basis to the firm and outside counsel in

various SEC and Public Company Accounting Oversight Board investigations and third-party litigation matters. He is a principallicensed Certified Public Accountant in Tennessee and founder of Five Radicals, which focuses on Baldrige Performance Excellence, strategic planning, general business consulting to entrepreneurial medical device companies,New York and private equity business development opportunity search efforts. He holds a Master of Arts in law and diplomacy from Tufts University and a Bachelor of Arts in political science and Bachelor of Science in accountingeconomics from PennsylvaniaSouth Dakota State University. Mr. FrielMcDermott was appointed to the board of directors of Genesco Inc. effective February 1, 2016 and currently serves as Chairman of its Audit Committee. Genesco is a publicly-traded retailer and wholesaler of branded footwear, apparel and accessories. Mr. McDermott brings extensive global general management knowledgesignificant expertise in the area of financial and practice. He has strong experienceinternal control reporting by publicly-traded companies. This expertise aligns with our responsibility and commitment to provide oversight for our shareholders and others relating to the integrity of our financial statements and related filings.

in building and growing businesses, especially in technical product development and global expansions, which align with many of the Company's initiatives and strategies.

Independent Directors

Our Nominating and Corporate Governance Committee has determined that each of Messrs. Anderson, Mulligan, Dutcher, Friel, Morgan and McDermott and Ms. Frame are “independent,”"independent," as that term is defined in Rule 5605(a)(2) of the NASDAQ Listing Rules. Accordingly, the Board is composed of a majority of independent Directors as required by the NASDAQ Listing Rules. In addition, none of our directors are a party to any agreement or arrangement that would require disclosure pursuant to NASDAQ Listing Rule 5250(b)(3) regarding the payment of compensation to directors by a third party in connection with serving as a director of the Company.

PROPOSAL TWO

ADVISORY (NON-BINDING) APPROVAL OF THE COMPANY'S EXECUTIVE COMPENSATION

The foundation of our executive compensation program is to pay for performance. Base compensation for our executive officers is set relatively low as compared to our peer groups, and a meaningful portion of the compensation paid to our executive officers is based on long-term equity incentive compensation and annual non-equity incentive compensation, which is focused on the key results and strategic drivers of our business. We believe that our executive compensation program aligns our incentive compensation with the long-term interests of our shareholders because it is designed to motivate our executives to deliver long-term sustainable growth and shareholder value and to provide retention incentives.shareholders.

Our Chief Executive Officer (“CEO”("CEO") and all of the other executive officers named in the Summary Compensation Table appearing later in this proxy statementProxy Statement (collectively, the “Named"Named Executive Officers”Officers") are subject to at-will employmentemployees consistent with applicable South Dakota state law. There are no employment agreements in place with any of the Named Executive Officers. We also do not maintain any supplemental executive retirement plans for our executive officers, and our Named Executive Officers participate in a retirement program that is open to all of our U.S. employees. We generally do not provide significant perquisites and other personal benefits.

We urge you to read the Compensation Discussion and Analysis section of this proxy statementProxy Statement for additional details on our executive compensation, including our compensation philosophy and objectives and the fiscal 20162018 compensation of our Named Executive Officers. We believe that, viewed as a whole, our compensation practices and policies are appropriate and are fair to both the Company and its executives.

Proposal

The U.S. Congress has enacted requirements commonly referred to as the “say-on-pay”"say-on-pay" rules. As required by those rules, we are asking you to vote on the adoption of the following resolution:

BE IT RESOLVED by the shareholders of Daktronics, Inc., that the shareholders approve the compensation of the Company's Named Executive Officers as disclosed pursuant to Item 402 of Regulation S-K in the Company's proxy statementProxy Statement for the 20162018 Annual Meeting.

Shareholder Approval

Proxies will be voted in favor of the resolution unless shareholders specify otherwise in their proxies and except for broker non-votes. The affirmative vote of at least a majority of the voting power of the shares present, in person or by proxy, and entitled to vote (excluding broker non-votes) is required for advisory approval of our executive compensation. As an advisory approval, this proposal is non-binding. However, the Board and our Compensation Committee, which is responsible for designing and overseeing the administration of our executive compensation program, value the opinions of our shareholders and will consider the outcome of the vote when making future compensation decisions for our Named Executive Officers.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR”"FOR" PROPOSAL TWO, THE ADVISORY (NON-BINDING) APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THE PROXY STATEMENT PURSUANT TO THE SEC’S COMPENSATION DISCLOSURE RULES.

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed ErnstDeloitte & YoungTouche, LLP ("Deloitte") as our independent registered public accounting firm ("the Independent(the "Independent Auditor") to perform reviews of our interim consolidated financial statements to be included in our fiscal 20172019 Quarterly Reports on Form 10-Q and to audit our annual consolidated financial statements and our internal control over financial reporting for fiscal 20172019, and it recommends that the shareholders vote for ratification of such appointment. Ernst & Young LLP has acted as our Independent Auditor since fiscal year 2003. A representative of Ernst & Young LLPDeloitte is expected to be present at the Annual Meeting, will have the opportunity to make a statement, and is expected to be available to respond to appropriate questions.

Recent Change in Auditor

As reported on the Company’s Current Report on Form 8-K filed on September 15, 2017 (the "Change in Auditor 8-K"), effective September 12, 2017, the Audit Committee dismissed Ernst & Young LLP ("EY") as the Company’s independent registered public accounting firm and appointed Deloitte to serve in this role for the fiscal year ended April 28, 2018. For more information, see the Change in Auditor 8-K, as amended by the Current Report on Form 8-K/A (Amendment No. 1) filed on December 1, 2017. A representative of EY is not expected to be present at the Annual Meeting.

EY audited the consolidated financial statements of the Company for the fiscal years ended April 29, 2017 and April 30, 2016. EY's audit reports for each of these fiscal years did not contain an adverse opinion or a disclaimer of opinion and, were not qualified or modified as to uncertainty, audit scope, or accounting principle.

During our two most recent fiscal years ended April 29, 2017 and April 30, 2016 and during the subsequent interim period from April 30, 2017 through September 12, 2017, (i) there were no disagreements with EY on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures that, if not resolved to EY's satisfaction, would have caused EY to make reference to the subject matter of the disagreement in connection with its reports and (ii) there were no "reportable events" as defined in Item 304(a)(1)(v) of Regulation S-K.

The Company provided EY with a copy of the Change in Auditor 8-K and requested EY to furnish the Company with a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements contained in the Change in Auditor 8-K. The Company received the requested letter from EY, and a copy of EY’s letter was attached as Exhibit 16.1 to the Change in Auditor 8-K.

During the two most recent fiscal years ended April 29, 2017 and April 30, 2016 and during the subsequent interim period from April 30, 2017 through September 12, 2017, neither we nor anyone on our behalf consulted Deloitte regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, and neither a written report nor oral advice was provided to us that Deloitte concluded was an important factor considered by us in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a "disagreement" (as defined in Item 304(a)(1)(iv) of Regulation S-K) or a "reportable event" (as defined in Item 304(a)(1)(v) of Regulation S-K).

Audit and Other Professional Fees

The following table presents the aggregate fees billed for professional services rendered by Ernst & Young LLPDeloitte and EY for the last two fiscal years are set forth inyear ended April 28, 2018 and by EY for the following table:fiscal year ended April 29, 2017:

| | | | | Fiscal Year Ended | | Fiscal Year Ended |

| | | April 30, 2016 | | May 2, 2015 | | April 28, 2018 | | April 29, 2017 |

Audit fees (1) | | $ | 862,625 |

| | $ | 795,470 |

| | $ | 951,029 |

| | $ | 887,897 |

|

Audit-related fees (2) | | 26,600 |

| | 26,200 |

| | 37,145 |

| | 25,200 |

|

Tax fees (3) | | | 26,179 |

| | — |

|

All other fees (3) | | 1,995 |

| | 1,995 |

| | 69,995 |

| | 1,995 |

|

| Totals | | $ | 891,220 |

| | $ | 823,665 |

| | $ | 1,084,348 |

| | $ | 915,092 |

|

| |

| (1) | Audit fees consist of fees related to professional services rendered in connection with the audit of our annual financial statements, the audit of our internal control over financial reporting, the reviews of the interim financial statements included in our Quarterly Reports on Form 10-Q and other professional services provided in connection with statutory and regulatory filings or engagements. |

| |

| (2) | Audit-related fees are fees for assurance and related services performed by Ernst & Young LLPEY and Deloitte that are reasonably related to the performance of the audit or review of the Company’s financial statements. |

| |

| (3) | All other fees are fees for other permissible work performed by Ernst & Young LLPEY and Deloitte that does not meet the above category descriptions. |

Audit and other professional fees for fiscal 2018 consisted of $162,134 paid to EY and $922,214 paid to Deloitte.

As provided in the Audit Committee’s charter, all engagements for any non-audit services by our Independent Auditor must be approved by the Audit Committee before the commencement of any such services. The Audit Committee may designate a member or members of the Audit Committee to represent the entire Audit Committee for purposes of approving non-audit services, subject to review by the full Audit Committee at its next regularly scheduled meeting.

The Audit Committee considers the provision of services by Ernst & Young LLPEY and Deloitte to us, over and above the audit fees, to be compatible with the ability of Ernst & Young LLPeach of EY and Deloitte to maintain its independence.

Shareholder Approval

The affirmative vote of a majority of the shares of our common stock represented at the Annual Meeting, either in person or by proxy, assuming a quorum is present, is required to ratify the appointment by the Audit Committee of the Board of Directors of ErnstDeloitte & YoungTouche, LLP as our Independent Auditor for the fiscal year ending April 29, 2017.27, 2019. If the shareholders do not approve the selection of ErnstDeloitte & YoungTouche, LLP, the Audit Committee will reconsider its selection.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR”"FOR" THE RATIFICATION OF THE APPOINTMENT OF ERNSTDELOITTE & YOUNGTOUCHE, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING APRIL 29, 201727, 2019 AS SET FORTH IN PROPOSAL THREE.

PROPOSAL FOUR

APPROVAL OF AN AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN

General

The Daktronics, Inc. Employee Stock Purchase Plan, or ESPP, was established by our Board and approved by our shareholders in 2002. Our Board and shareholders authorized the issuance of 2,500,000 shares under the ESPP. On May 30, 2018, our Board approved, subject to shareholder approval, an amendment to the ESPP to increase the number of shares authorized under the ESPP to 4,000,000 (an increase of 1,500,000 shares).

Our Board believes that the amendment to the ESPP is in our and your best interests and is important to help assure our ability to continue to recruit and retain highly qualified employees. As of April 28, 2018, 173,232 shares of our common stock remained available for purchase under the ESPP. If the amendment to the ESPP is not approved by shareholders, we will exhaust these previously authorized shares in the coming months or years and then our employees will no longer be able to purchase shares of our common stock under the ESPP.

Below is a summary of the material features of the ESPP. The summary is qualified in its entirety by reference to the full text of the ESPP as proposed to be amended, which is included as an appendix to this Proxy Statement.

Summary of the Amended ESPP

Available Shares. The aggregate number of shares of common stock to be reserved by the Company and available for purchase under the ESPP is 4,000,000 shares.

Purpose. The purpose of the ESPP is to provide eligible employees with an opportunity to increase their proprietary interest in the success of the Company by purchasing common stock from the Company on favorable terms and paying for such purchases through periodic payroll deductions.

Administration. The ESPP is administered by the Compensation Committee (the "Committee"). The Committee interprets the ESPP and makes all other policy decisions relating to the operation of the ESPP.

Eligibility. Any employee of the Company (or any designated subsidiary) whose customary employment is for more than five months per calendar year and for more than 20 hours per week and who has been employed for at least six months at the start of an offering period is eligible to participate in the ESPP. As of the Record Date, there were approximately 2,180 employees who were eligible to participate in the ESPP. No employee is permitted to purchase common stock under the ESPP if such employee owns more than five percent (5%) of the total combined voting power or value of all classes of our stock (including shares which may be purchased under the ESPP, and no employee is entitled to purchase shares having a fair market value of more than $25,000 in any calendar year.

Contribution Period. Each calendar year, two offering periods each with a duration of six months commence on November 1 and May 1. Each offering period contains one six-month contribution period, with purchases occurring at the end of each six-month contribution period.

Purchase Price. The price of each share of common stock purchased under the ESPP is 85% of the lower of (i) the fair market value per share of common stock on the last trading day of the offering period or (ii) the fair market value per share of common stock on the last trading day before the offering date. The purchase price of the shares is accumulated by payroll deductions over each contribution period. The deductions may not exceed 15% of an employee's compensation, and no more than 4,000 shares may be purchased on any purchase date. All payroll deductions of a participant are credited to his or her account under the ESPP, and such funds may be used for any corporate purpose.

Termination. Employees may end their participation in the ESPP at any time during the contribution period, and participation ends automatically upon termination of employment with the Company.

Amendment. The Board may amend or terminate the ESPP at any time. However, the Board may not, without shareholder approval, increase the number of shares of common stock reserved for issuance under the ESPP.

Antidilution Provisions. The Board of Directors must equitably adjust the maximum number of shares of common stock reserved for issuance under the ESPP in the event of stock splits or consolidations, stock dividends or other transactions in which the Company receives no consideration.

New Plan Benefits

Benefits and purchases of shares of our common stock under the ESPP depend on elections made by employees and the fair market value of our common stock on dates in the future. As a result, it is not possible to determine the benefits that will be received by executive

officers and other employees in the future under the ESPP. As described above, no employee may purchase shares under the ESPP at a rate that exceeds $25,000 in fair market value in any calendar year.

Summary of U.S. Federal Income Tax Consequences

The ESPP is intended to be an "employee stock purchase plan" within the meaning of Section 423 of the Internal Revenue Code of 1986 (the "Code"). Under such a plan, no taxable income is recognized by participants, and no deductions are allowable to the Company either when a purchase right is granted at the beginning of the offering period or when shares are purchased at the end of a contribution period.

The Internal Revenue Service (the "IRS") has in the past stated that participants will recognize income in the year in which they make a disposition of the purchased shares. The term "disposition" generally includes any transfer of legal title, whether by sale, exchange or gift. It does not include a transfer to a participant's spouse, a transfer into joint ownership if the participant remains one of the joint owners or a transfer into a participant's brokerage account. Hence, a participant will be subject to federal income tax on the purchased shares only when he or she disposes of them.

A participant's federal income tax liability will depend on whether he or she makes a qualifying or disqualifying disposition of the purchased shares. A qualifying disposition will occur if the sale or other disposition of those shares is made after the participant has held the shares for (a) more than two years after the start date of the applicable offering period, and (b) more than one year after the actual purchase date. A disqualifying disposition is any sale or disposition which is made before either of these two holding periods is satisfied.

If a participant makes a qualifying disposition, he or she will recognize ordinary income in the year of the qualifying disposition equal to the lesser of (a) the amount by which the fair market value of the shares on the date of the qualifying disposition exceeds the purchase price paid for those shares, or (b) 15% of the fair market value of the shares on the start date of the offering period during which those shares were purchased. The Company is not entitled to an income tax deduction with respect to such disposition. Any additional gain recognized by the participant upon the qualifying disposition will be taxed as long-term capital gain. If the fair market value of the shares on the date of the qualifying disposition is less than the purchase price a participant paid for the shares, there will be no ordinary income, and any loss recognized will generally be a long-term capital loss.

If a participant disposes of the shares acquired under the ESPP prior to meeting either of the above-described holding periods, he or she will recognize ordinary income in the year of disposition equal to the difference between the fair market value of the shares at the date of exercise and the purchase price and capital gain or loss equal to the difference between the amount realized on the sale and the fair market value on the date of exercise. The amount of the ordinary income will be added to the participant's basis in the shares, and any resulting gain or loss realized will be treated as long-term capital gain or loss if the participant held the stock at least 12 months. The Company is entitled to an income tax deduction in the amount of the ordinary income recognized by the participant with respect to the disqualifying disposition.

The foregoing is only a summary of the general effect of the U.S. federal income taxation upon participants and the Company with respect to the purchase of shares under the ESPP and the subsequent sale of such shares, and it does not purport to be complete. This summary does not discuss the tax consequences of a participant's death or the income tax laws of any state or foreign country in which a participant may reside. A participant should consult his or her own tax advisor as to the tax consequences of any particular transaction under the ESPP.

Vote Required

The ESPP is designed to qualify for favorable tax treatment under Section 423 of the Code. To maintain this qualification, we must obtain shareholder approval of the amendment to the ESPP within 12 months of the Board’s approval date. The affirmative vote of a majority of the votes cast by shareholders entitled to vote who are present in person or represented by proxy is required to approve the amendment to the ESPP.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE APPROVAL OF THE AMENDMENT TO OUR EMPLOYEE STOCK PURCHASE PLAN AS SET FORTH IN PROPOSAL FOUR.

CORPORATE GOVERNANCE

Board Leadership Structure

The Board of Directors adheres to governance principles that assure the integrity and continued viability of the Company. The Board has responsibility for risk management oversight and for providing strategic guidance to the Company. The Board believes that it must stay well-informed about the issues, challenges and opportunities facing Daktronics so that the Board members can properly exercise their fiduciary responsibilities to our shareholders. As part of this process, the Board is kept informed of our business through discussions with the Chief Executive Officer and other officers, by reviewing material provided to them and by participating in meetings of the Board and its Committees.

Dr. Aelred Kurtenbach, one of our founders and our first Chief Executive Officer ("CEO"), served as Chairman of the Board from the Company's inception until September 2014. When he retired from the CEO responsibilities in 2001, the Board separated the Chair and CEO roles and retained Dr. Kurtenbach as Chair in order to continue to benefit from his leadership. The Board has also established a Lead Independent Director role. Ms. Nancy Frame has served as our Lead Independent Director since 2005. When Dr. Kurtenbach retired as Chairman of the Board in September 2014, the Board studied and discussed publicly available research and expert guidance on different structures. After this study and discussion, the Board determined that a return to the combined Chair and CEO roles plus a Lead Independent Director role would best serve the Company and its shareholders going forward.

The Chairman conducts the Board meetings, and the Lead Independent Director presides over independent Director meetings. The Lead Independent Director also serves as chairperson of the Nominating and Corporate Governance Committee. In this dual role, the Lead Independent Director is able to bring to the Board a special focus on governance issues. She also facilitates the ability of non-management Directors to fulfill their responsibilities, builds consensus among Board members and provides a structure for communicating any concerns the non-management Directors may have directly to our executive management.

Our governance practices are compliant with the NASDAQ Listing Rules and the corporate governance regulations of the Sarbanes-Oxley Act of 2002. Among other things, these practices include the following:

The Nominating and Corporate Governance Committee reviews with the Board annually the composition of the Board as a whole, including the Directors’ independence, skills, experience, age, diversity and availability of service to the Company.

The Nominating and Corporate Governance Committee recommends Director candidates for approval by the Board and election by the shareholders, taking into account the Company’s need for diverse skills, professional experiences, backgrounds and other qualities to ensure a variety of viewpoints.

The Board conducts periodic self-evaluations facilitated by the Nominating and Corporate Governance Committee.

The independent Directors meet in conjunction with regularly scheduled quarterly Board meetings and at other appropriate times.

The Board and all Board Committees are authorized to hire their own advisors as they deem to be necessary or advisable to fulfill their obligations, and the Company will pay the costs of such advisors.

Meetings of the Board of Directors and Committees

During fiscal 20162018, the Board of Directors held four regularly scheduled meetings and one special meeting, the Audit Committee met nineeight times, the Compensation Committee met fourseven times, and the Nominating and Corporate Governance Committee met four times. All of the Directors attended at least 75 percent of the aggregate of all meetings of the Board of Directors and Committees upon which they served, and all of the Directors attended the annual meeting of shareholders held in SeptemberAugust 20152017.

Executive Sessions of the Board

The Board has adopted a practice of meeting in executive session, and then with independent Directors only, in conjunction with each regularly scheduled Board meeting. The independent Directors met four times in fiscal 2016.2018.

Annual Meeting Attendance Policy

As set forth in our Corporate Governance Guidelines, members of the Board of Directors are expected to devote sufficient time and attention to prepare for, attend and participate in Board meetings, shareholder meetings and meetings of Committees of the Board on which they serve.

Board’s Role in Risk Oversight

The Board takes an active role in risk oversight both as a full Board and through its Committees. The Company's management team attends a portion of each regular Board meeting, and the Board engages management in a review of the business with respect to our strategies and risks. Such risks include those inherent in our businesses as well as the risks from external sources such as competitors, the economy, credit markets and regulatory and legislative developments.

The various Committees of the Board are also responsible for specific areas of risks. The Audit Committee meets regularly with management and our independent registered public accounting firm to oversee our financial risk management processes, controls and capabilities. The Audit Committee also oversees and reviews with management certain aspects of our credit, litigation, and currency risks and other finance matters. In addition, the Audit Committee reviews and monitors our procedures regarding the receipt, retention and treatment of complaints regarding internal accounting, accounting controls or audit matters. The Compensation Committee oversees our executive compensation arrangements and certain benefit plans. This includes the identification and management of risks that may arise from our compensation policies and practices. The Nominating and Corporate Governance Committee has oversight of corporate governance, including practices and procedures that promote good governance and thus mitigate governance risk, and it is also responsible for reviewing the performance of the Board, its Committees and their members. These Committees report to the full Board on these topics, including risks, as they deem to be necessary or advisable.

Code of Conduct

The Board of Directors has adopted our Code of Conduct, which applies to all of our employees, officers and Directors as described in our Annual Report to Shareholders. Included in the Code of Conduct are ethics provisions that apply to our Chief Executive Officer, Chief Financial Officer, and all other financial and accounting management employees. Copies of the Code of Conduct are available on our website at www.daktronics.com. The Nominating and Corporate Governance Committee reviews the Code of Conduct annually and oversees its implementation.

Policy and Procedures with Respect to Related Party Transactions

Our Board of Directors has adopted a written policy and procedure with respect to related party transactions, which the Audit Committee oversees. Under the policy, a “related"related party transaction”transaction" is generally defined as a transaction, arrangement or relationship in which the Company was, is or will be a participant; the amount involved exceeds $120,000; and in which any “related person”"related person" had, has or will have a direct or indirect material interest. The policy generally defines a “related person”"related person" as a Director, executive officer or beneficial owner of more than five percent of any class of our voting securities and any immediate family member of any of the foregoing persons.

The Audit Committee reviews and, if appropriate, approves related party transactions, including certain transactions which are deemed to be pre-approved under the policy. On an annual basis, the Audit Committee reviews any previously approved related party transaction that is ongoing.

Committees of the Board of Directors

The Board of Directors currently has three standing Committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee. During fiscal 20162018, our Audit Committee consisted of Kevin P. McDermott (Chairperson), John L. Mulligan, (Chairperson), Byron J. Anderson (beginning May 1, 2015 through September 3, 2015), John P. Friel, (beginning September 3, 2015), and Kevin P. McDermott (beginning August 17, 2015). Upon a prior board member's resignation from the Board effective May 1, 2015, Mr. Anderson was appointed to the Audit Committee. Mr. Anderson served on the Audit Committee through September 3, 2015, when Mr. Friel were appointed to the Audit Committee.James B. Morgan. The Board of Directors has determined that each Audit Committee member is independent as defined under Rule 5605(a)(2) of the NASDAQ Listing Rules and Rule 10A-3 under the Securities Exchange Act of 1934 (“("Exchange Act”Act"). The Board has determined that Mr. Mulligan, Mr. McDermott, Mr. Friel, and Mr. McDermottMorgan are qualified as “audit"audit committee financial experts,”" as that term is defined in Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities concerning the quality and integrity of our financial reports and related filings with the SEC. In fulfilling this role, the Audit Committee, among other things, oversees the accounting and financial reporting process and audits of the financial statements and related SEC filings, appoints and determines the compensation of our independent registered public accounting firm,Independent Auditor, reviews the scope and findings of the audit, reviews the adequacy and effectiveness of our accounting policies and system of internal control over financial reporting, and oversees our policy and procedures with respect to related party transactions. The Audit Committee’s Charter is available on our website at www.daktronics.com.

Compensation Committee. During fiscal 20162018, our Compensation Committee consisted of Robert G. Dutcher (Chairperson), Byron J. Anderson, and Nancy D. Frame.John P. Friel. All of the Compensation Committee members satisfy the independence requirements of the NASDAQ Listing Rules, as determined by the Board of Directors. The Compensation Committee annually reviews and approves the Chief Executive Officer’s and other executives' compensation packages and acts upon management’s recommendations for executives concerning employee equity incentives, bonuses and other compensation and benefit plans. The Compensation Committee’s Charter is available on our website at www.daktronics.com.

Nominating and Corporate Governance Committee. During fiscal 20162018, our Nominating and Corporate Governance Committee (the “Nominating Committee”"Nominating Committee") consisted of Nancy D. Frame (Chairperson), Byron J. Anderson and John P. Friel.James B. Morgan. The Board of Directors has determined that all of the Nominating Committee members satisfy the independence requirements of the NASDAQ Listing Rules. Our Nominating Committee advises and makes recommendations to the Board of Directors on all matters concerning the selection of candidates as nominees for election as Directors, develops and recommends to the Board of Directors corporate governance guidelines,

oversees our Code of Conduct, and provides oversight with respect to corporate governance and ethical conduct. It also facilitates the annual review of the performance of the Board of Directors. The Nominating Committee’s Charter and our Corporate Governance Guidelines are available on our website at www.daktronics.com.

The information below describes the criteria and process that the Nominating Committee uses to evaluate future candidates to the Board of Directors:

Director Qualification

When Board candidates are considered, they are evaluated based upon various criteria, such as their broad-based business and professional skills and experiences, experience serving as management or on the board of directors of other organizations, concern for the long-term interests of the shareholders, technology company experience, financial literacy, personal integrity and judgment and their willingness to be prepared and active participants at Board and Committee meetings. The Nominating and Corporate Governance Committee and the Board seek to attract and retain highly qualified Directors who have sufficient time to attend to their duties and responsibilities to the Company.

The Nominating and Corporate Governance Committee and the Board seek members who will contribute to our overall corporate goals, taking into account:

The Company’s responsibility to its key stakeholders, which include shareholders, customers, suppliers, community and employees.

Integrity in financial reporting and business conduct. Candidates are selected based upon their potential contributions to the long-term interests of shareholders.

Diversity of a candidate’s skills and experiences.

Each candidate for Director must possess the following specific minimum qualifications: